Diversify Business of Your choice with SMD Consulting

Can you Diversify to new Business in new area ,yet become number 1?

Yes , Contact us for our Equity investing Business Model ,

with Guaranteed results and proven actual cases

Yes, acquiring a stake in another business through the stock market can be a viable business diversification strategy. This approach is known as a "financial diversification" or "portfolio diversification" strategy.

Here are some ways to achieve business diversification .

1. *Equity investing*: Buy shares of another company to gain a minority stake.

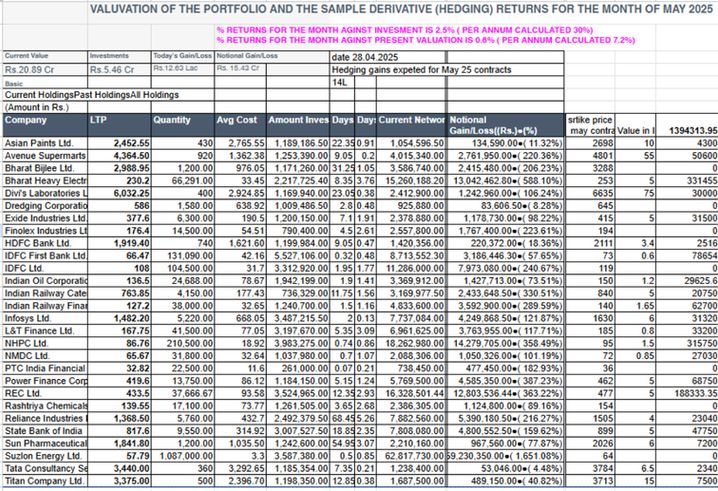

2. Ensure monthly returns through ,Hedging

3. Enjoy addition yearly returns in the form of dividend.

4. Enjoy exponential capital return longer time horizon.

This approach offers benefits like:- Diversified revenue streams- Access to new markets, technologies, or expertise- Risk management through portfolio diversification- Potential for long-term capital appreciation

However, it's essential to conduct thorough research, due diligence, and financial analysis before making any investment decisions.

SMD Consulting will be carrying out

these activity including training to your staff.

We have worked as Business Partner for HDFC /ICICI SECURITIES

However you are free to select any of full service brokerage of your choice like Motilal Oswal. SBI. Angel , Kotak.

Our hedging technique will be helpful in regular returns.

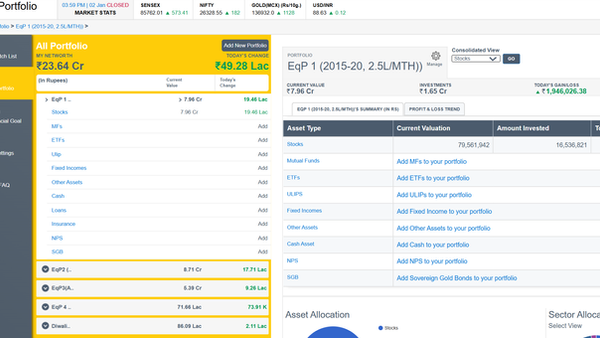

Just go through the results live as on 02.01.2026 , complete details are explained as you scroll down.

Comparison of Conventional Business Activity /process for Manufacturing

Vs Business Model Proposed By SMD Consulting- 9 STEPS

1. Land/ Building requirement : Get new or allocate sufficient space from existing as per requirement Vs

Minimum space as good as sitting and lap top

2. Machinery and asset creation: Buy machinery which is generally done by bank loans and there on pay fix instalments which will affect profitability due to interest cost or capex planning through yearly budgeting . Vs

Just like capex planning through yearly budgeting as per fund availability so no worry of interest costs

3. Asset valuation :Take depreciation benefit but actual value of assets also depreciates Vs

Assets keep appreciating and compounding effect is beyond imagination

4. Manufacturing/ marketing/ working cost /Overheads

Sizable Vs Minimal

5. Flexibility to change business :

Difficult Vs At click of mouse

6. Liquidity of assets : In case want to change business Difficult and also will be done at Depreciated value Sizable Vs appreciated value and easy liquidity.

7. Inventory control : Dynamically need to manage Vs Comparatively simple

8. Profitability assessment: As per billing generally on monthly(MFR) and yearly basis. Vs Weekly, monthly and Yearly basis profits are en cashed .

9. Ability to Run independently Yes can be since inception Vs It will compliment main manufacturing initially and once becomes sizable can work independently . As per the actual results diversified business value can be near to original business over the years .

Strategy – Transforming investment to Business Model

1

Equity Investing

Invest on monthly Basis in Good Stocks by Allocating in Company Budget just like capex , as minority stake purchase

2

Compounding Power

Ensure consistent returns with advanced techniques using derivatives besides dividend and Capital Appreciation

3

Expected results

12L per month investment below returns can be achieved

(@ 2 years 3.2 Cr, @ 5 years 9.7 Cr , @10 years 26 Cr, @15years 57Cr and @20 years 110 Cr conservative returns of 12% is considered . The actual case studies with 2.5L and 12L monthly with details Given below )

Previous Performance as on 17.2.24

(for 2.5L monthly investment for 66 months refer first two rows

Third Row 12L Monthly investment for 18 month)

As on 20-7-24 EP1 (Equity portfolio 1) Investment of 2.5L monthly for 5.5 years 2015 - 2020

As on 20-07-24 EP2 (Equity portfolio 2) Investment of 2.5L monthly for 5.5 years 2015 - 2020

As on 20.07-24 EP3 Equity Portfolio 3 ( Investment 12L per month for 1.5 years (april 22 to sep 23)

As on 20.07-24 Equity Portfolio EP1+EP2+EP3